How to get 'free' e-PAN using Aadhaar

A permanent account number (PAN) is a ten-character alphanumeric identifier, issued in the form of a laminated "PAN card", by the Indian Income Tax Department, to any "person" who applies for it or to whom the department allots the number without an application. It can also be obtained in the form of a pdf if the User doesn't wish to obtain it physically.

A PAN is a unique identifier issued to all judicial entities identifiable under the Indian Income Tax Act, 1961. The income tax PAN and its linked card are issued under Section 139A of the Income Tax Act. It is issued by the Indian Income Tax Department under the supervision of the Central Board for Direct Taxes (CBDT) and it also serves as an important proof of identification.

After launching the beta-facility in February 2020, to provide instant Permanent Account Number (PAN) to an individual having Aadhaar number, the Finance Minister Nirmala Sitharaman has officially launched this facility today. This is a paperless, free-of-cost facility where you will get an e-PAN in near real-time on the basis of Aadhaar based e-KYC.

The official launch follows the announcement made by FM in the Union Budget 2020. According to income tax department, using the beta version, the department received 6.88 lakh requests for instant PAN up to 25/05/2020 and 6.77 lakh instant PAN were alloted with turn around time of 10 minutes.

How to apply for instant PAN

Step 1: Visit www.incometaxindiaefiling.gov.in

Step 2: Under the 'Quick Links' option, click on 'Instant PAN through Aadhaar'.

Step 3: Click on 'Get New PAN' option'

Step 4: Enter your Aadhaar number, captcha code, and confirm. You will be required to select a tick box. The tick box will confirm that:

1. You have never been allotted a PAN

2. Your mobile number is linked with Aadhaar number

3. Your complete date of birth in (DD-MM-YYYY) format is available on Aadhaar card

4. You are not minor as on application date of PAN.

5. You have read the terms and conditions.

Step 5: Click on 'Generate Aadhaar OTP'. A one-time password (OTP) will be sent on your mobile number registered in Aadhaar database.

Step 6: Enter the OTP in the required space.

Step 7: Validate your Aadhaar details. Check if the name, date of birth and other details shown are correct.

Step 8: Once the details are submitted successfully, an acknowledgement number will be generated. Acknowledgement number will be sent to you via SMS and email (if given).

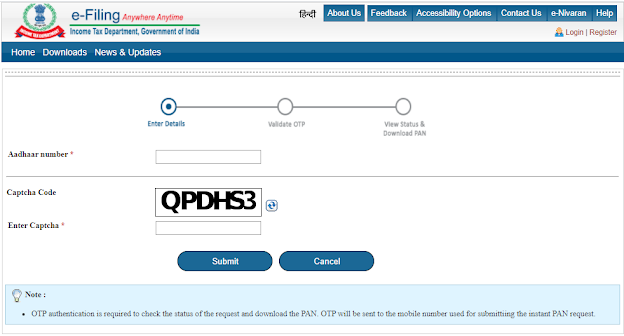

How to download instant PAN

Once you have applied for PAN using this facility, follow the steps below to download the PAN.

Step 1: Go to www.incometaxindiaefiling.gov.in

Step 2: Click on 'Instant PAN through Aadhaar' under the 'Quick Links' section.

Step 3: Click on 'Check Status of PAN'.

Step 4: Submit the Aadhaar number in the required space, an OTP will be sent on your mobile number registered with the UIDAI database.

Step 5: Enter the OTP in the required space.

Step 6: Check if the PAN is allotted to you. If it has been allotted to you, then click on the download link to get a copy of the e-PAN.

Tags: PAN Card | Pan | Aadhaar

No comments: